By Kyle Munn

At the Center for the Advancement of Social Entrepreneurship (CASE), we’re obsessed with one question: How do social entrepreneurs leap the chasm from idea to sustainable impact at scale? Based at the Fuqua School of Business at Duke University, CASE has been tackling this and related questions for the past 15 years. We are proud to be a partner organization with SOCAP16, helping to foster an ecosystem of social impact.

The Challenges of Raising “Smart” Capital

Social entrepreneurs are busy people with many competing claims on their time. Raising capital can demand an overwhelming amount of this time, and yet many entrepreneurs end up with capital that is not a great fit for their business’s growth and/or impact.

We at the Center for the Advancement of Social Entrepreneurship (CASE) have heard from hundreds of social entrepreneurs that they crave the opportunity to learn how to be more targeted and successful in raising capital and scaling their impact. The challenges of identifying the right investors, communicating the right balance of information, and analyzing investment offers are ones that all social entrepreneurs need to address to raise capital that is “smart” for their ventures.

Traditional accelerator programs for social ventures strive to address many of these challenges, but are often constrained themselves. Accelerators are typically short-term and have a more general focus, but entrepreneurs’ needs and opportunities are constantly changing. We hear from accelerators that their ability to respond to just-in-time entrepreneur needs, and to provide the right expertise at the right time, is often limited.

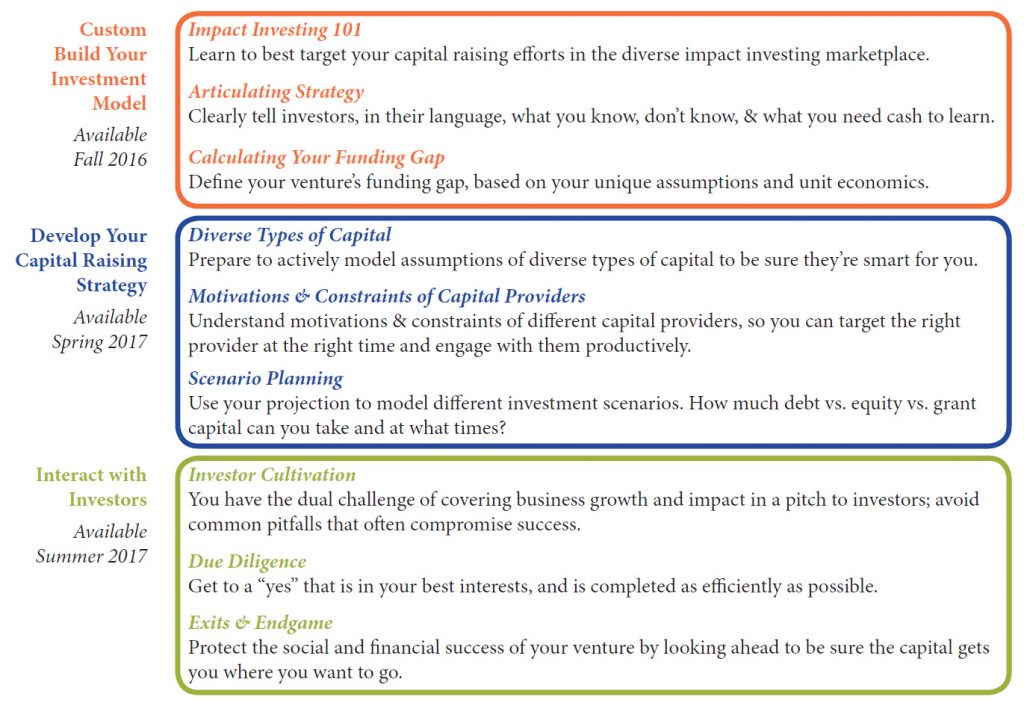

To address these challenges, and to complement the important work of accelerator programs, CASE began development of CASE Smart Impact CapitalTM, a series of online training modules that take the lessons learned from 15 years of work with investors and social entrepreneurs around the world to address the needs and pitfalls social ventures face when seeking investment capital. The modules are designed to be entrepreneur-friendly - straightforward, flexible, and with frameworks and tools that lead to actionable decision making.

Smart Impact Capital™ modules

The modules are designed to allow users to access exactly the information they need in the moment, rather than following a linear curriculum. Not sure whether equity or debt is right for your company? The Calculating Your Funding Gap module walks you through the process of building your cash model and calculating your funding gap, and the Scenario Planning module lets you see the effects of different types of capital on your bottom line. How do you balance business growth and impact evidence when speaking to investors? Our Articulating Strategy to Investors and Motivations of Capital Providers modules give you tools to speak about both dimensions and insight into the right balance you should strike for different audiences.

In total, nine modules walk entrepreneurs through the core tactics needed to be successful when raising “smart” capital. Over the past few months we have invited a number of social entrepreneurs, impact investors, and other intermediaries to beta test the first two modules; the overwhelmingly positive response we received validates the need for these tools.

“I usually am a bit jittery about getting involved in online or remote kinds of training because of the lack of interpersonal communication. This was amazing. I could do it at my own pace,” said Sam Gwer, cofounder of Kenyan social venture Afya Research, of his recent experience beta testing the modules with his management team.

“You could think about growth and your financials from the unit perspective and from the whole organizational perspective,” explains Sam. “I keep on getting feedback that some of our unit managers who are still using [the financials spreadsheet]. And they say that this thing works so well because they can just change a figure here and see what that impacts on the whole growth experience.”

Soon we will be launching the new CASE Smart Impact CapitalTM platform with the opportunity to explore elements of the modules and see how they could benefit your accelerator program or social venture. We invite you to visit www.CASEsmartimpact.com after September 15th, or to sign up for announcements on the release of the new platform on our interim site. You can also follow CASE on Twitter and Facebook.

Kyle Munn is the Program Coordinator for Communications and Marketing at CASE. Before coming to Duke University, Kyle was an ESL instructor with the Japan Exchange and Teaching (JET) Programme where she also served as a community outreach coordinator for AJET in Shiga Prefecture. You can follow her on Twitter.